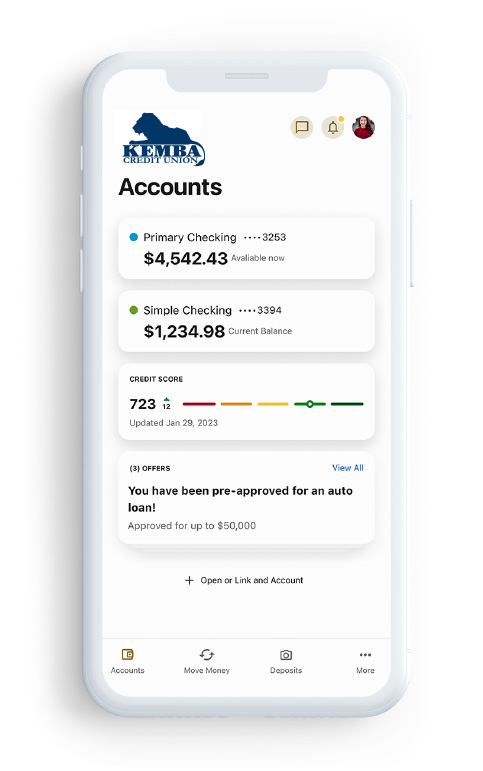

New Mobile Banking apps are available, download today!

A brand-new digital banking experience designed to serve you is here! Kemba's updated digital banking platforms include:

- New consumer friendly design

- Tools to help manage your accounts

- Financial wellness tips

- Personalized offers

- Enhanced security

- Ability to link external accounts

- Push notifications

- And so much more!

Online Banking

- Free, secure, and easy-to-use service for Kemba CU members

- Available to both personal and business members

- Manage a number of banking activities anytime, anywhere with internet access:

- Access eStatements

- View account balances and history

- Transfer funds between accounts (one-time and recurring transfers)

- View checks written

- Make loan payments

- Access MyMoney

- And more

Bill Pay

- Pay one-time or recurring bills with ease:

- Schedule payments in advance

- Set up payment reminders

- Ensure payments are received on time

- Have all payee information in one convenient place

- Retain funds until paper drafts are presented for payment

- Avoid paper clutter

- More secure than paper billing

- Make more time for yourself; fewer bank trips necessary

- Print or download to popular financial management software like Quicken, QuickBooks, or Mint

Mobile Banking

- Fast, free, and secure service for consumers enrolled in Online Banking

- Available to personal and business consumers

- Easily keep track of your finances — even on the go

- Available via any web-enabled cell phone or device1

- And much more!

Access your accounts from anywhere with Mobile Banking

Pay bills, pay loans, view balances, and deposit checks easily when you download the free app. It's simple to use — and transport. Throw a Kemba branch right into your pocket or purse and bank from anywhere.

Need the app? Download it today!![]()

![]()

iPhone Download on the App Store® | Android Get it on Google Play™

1Data charges may apply. Mobile Deposit is available only for savings and checking accounts in good standing and must meet certain criteria. Not all accounts will be eligible. Transaction and amount limits will apply.

Card Controls

Card Controls through the mobile app allow you to:

- Freeze or unfreeze card(s)

- Mark a card as lost and reorder

- Tell us your travel plans

eStatements

eStatements offer many benefits including:

- 24/7 online access

- Conserve paper

- Printable directly from your online application

- Free

You will need to contact us at 513-762-5070 or visit a local branch office.